Date: Tue, 11 Oct 2011 23:38:18 +0200

<http://www.africa-confidential.com/article/id/4181/Good_boom%2c_bad_timing>

Good boom, bad timing

Asian demand for African agricultural and mineral commodities will not fully

compensate the losses caused by the West's economic slowdown.

11th October 2011

Africa has picked a really bad time to launch its economic boom, says one

finance minister resignedly. In Washington for the World Bank and

International Monetary Fund annual meetings on 23-25 September, he had just

heard the Bank's Chief Economist for Africa,

<http://www.africa-confidential.com/whos-who-profile/id/3109/Shantayanan_Dev

arajan> Shantayanan Devarajan, talk about the continent's 'robust growth'.

The Bank puts this at about 4.8% on average in 2011, with the IMF projecting

it at 5.2%. Of the world's 15 fastest-growing economies, Devarajan

explained, 10 were from Africa, including Ghana, where the start of oil and

gas export should produce gross domestic product growth of over 13% this

year.

Then the finance minister went to hear Bank President

<http://www.africa-confidential.com/whos-who-profile/id/2463/Robert_Zoellick

> Robert Zoellick describe how the economic travails of the United States

and the Eurozone (some US$7.6 trillion wiped off equity markets so far, say

Bank economists) were spreading to developing economies, including Africa's

'frontier markets'. Now a greater risk loomed, he argued: the drop in

markets and confidence could mean that big developing countries - such as

China, India and Brazil - would cut back their investment plans and their

consumers would cut spending.

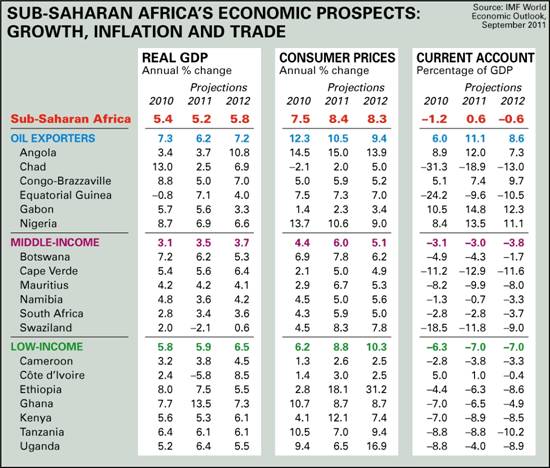

Sub-Saharan Africa's economic prospects: growth, inflation and trade

Asian demand for agricultural commodities and minerals cannot yet compensate

Africa for the slowdown in Western demand, despite a shift of global

purchasing power from West to East. So a double-dip recession in the USA or

a worsening crisis in the Eurozone triggered by a Greek default would

quickly, if indirectly, weaken African economies. Some 37% of Africa's

non-oil exports go to the European Union. Faltering growth in North America

and Europe will cut export earnings, remittances, private capital flows and

aid to Africa. Economists reckon that a 1% fall in Western growth rates

translates into a similar fall in African economies.

Few economists at the Washington meetings were certain Western economies

would this year repeat the 2008 crash but many advised developing economies

to prepare for more pummelling of markets and state treasuries. Even in

Africa's best-managed economies, with low budget deficits, there is far less

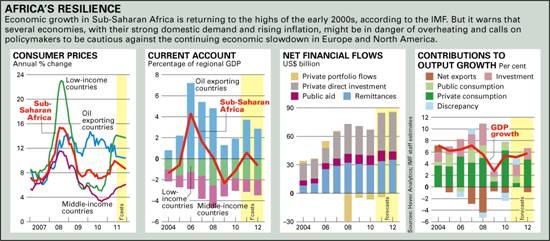

room to manoeuvre now than there was in 2008. African consumer prices rose

on average by 10% in the year to May 2011, up from 7.5% a year earlier. Some

countries are seeing sharper price rises, creating political problems.

For example, Kenya's economy has rebounded quite strongly since the

political crisis of 2007-08 and the global crisis in the same period but the

government has run fiscal deficits of 5-6% a year and now has a debt-to-GDP

ratio of over 50%. With elections next year, the governing coalition parties

want to raise money and don't want the blame for austerity measures. With a

regional drought, spiralling food prices and a plummeting currency,

something will have to give. Some suspect that politicians playing the

foreign exchange markets are pushing down the shilling's value.

Africa's resilience

Kenya's difficulties are repeated in Ethiopia and Uganda where inflation is

rising and political discontent growing. African finance ministers do not

expect much relief from outside. They recognise that sentiment in rich

Western countries hasmoved against aid and that private capital - which

makes up most flows to Africa - is likely to be more selective. Of the

African fiscal deficits during the 2008 crisis, some 80% were financed from

domestic resources, Shanta Devarajan noted.

At least that helped to develop banking systems and financial sectors, as

well as send governments on a tax collection campaign. The same is happening

now, with tax authorities getting tougher on corporate profits and

royalties, particularly in the oil and mining sectors. Global food prices

are now 26% higher than a year ago and the price of rice - an 'essential

commodity' for many African middle classes and therefore politically

sensitive - went up by 5% in August alone.

Sharply rising food prices have prompted more debate about how

developing-country governments can reduce risk. The World Bank helps

countries to set up financial market insurance and other risk management

strategies, such as crop insurance. Senior officials at the United Nations

Conference on Trade and Development says these are largely ineffectual and

instead want tighter regulation of the role that financial investors and

speculators play in commodity markets, as well as restrictions on banks that

have inside information about commodity market movements.

Prospects for such regulation look poor, given entrenched opposition from

banks and Western governments. French calls for a Financial Transactions Tax

are gathering broader support, though, with Britain and the USA among the

main opponents. In Washington, several African governments, including

Congo-Kinshasa and Liberia, mooted tough tax regimes for mining and oil

companies. The Bank's Vice-President for Africa,

<http://www.africa-confidential.com/whos-who-profile/id/2605/Obiageli_Ezekwe

sili> Obiageli Ezekwesili, said the push for more accountability in natural

resource revenue was a basic minimum of reform, which has led to a review of

tax and royalty payments and how countries could maximise 'the value of

their endowment'. The Bank helps countries to set up sovereign wealth funds

to better manage revenue and, in some cases, pays for expert advisors to

assist governments negotiating fiscal terms with international oil and

mining companies.

Amid the gloom, the Bank's Chief Economist Justin Yifu Lin put a positive

spin for Africa. The rapid wage increases in China and India would push

labour-intensive manufacturers to relocate to countries with low wages.

'Labour-abundant countries should grasp that opportunity to diversify their

economies,' he said. 'There are opportunities for African countries to grow

as dynamically as the East Asian countries, not only for a short period of

time - it can be 10, 20 or 30 years.' Coming from a man who was founding

director of the China Centre for Economic Research during a period of

exponential agricultural and industrial growth, Lin's views carry weight.

------------[ Sent via the dehai-wn mailing list by dehai.org]--------------

(image/jpeg attachment: image001.jpg)

(image/jpeg attachment: image002.jpg)