African energy-Eastern El Dorado?

At long last east Africa is beginning to realise its energy potential

Apr 7th 2012 | ADDIS ABABA, KAMPALA AND MOMBASA | from the print edition

IN ENERGY terms, east Africa has long been the continent's poor cousin.

Until last year it was thought to have no more than 6 billion barrels of

proven oil reserves, compared with 60 billion in west Africa and even more

in the north. Since a third of the region's imports are oil-related, it has

been especially vulnerable to oil shocks. The World Bank says that, after

poor governance, high energy costs are the biggest drag on east Africa's

economy.

All that may be about to change. Kenya, the region's biggest economy, was

sent into delirium on March 26th by the announcement of a big oil strike in

its wild north. A British oil firm, Tullow, now compares prospects in the

Turkana region and across the border in Ethiopia to Britain's bonanza from

the North Sea. More wells will now be drilled across Kenya, which also holds

out hopes for offshore exploration blocs.

Kenya's find raised less joy in Uganda, where oil was first struck in 2006.

Tullow, together with China's CNOOC and Total of France, will start pumping

it next year, initially at a paltry rate of 5,000 barrels a day (b/d). But

the Lake Albert basin, which straddles the border between Uganda and Congo,

holds over a billion barrels of proven reserves and possibly twice that in

potential finds. Uganda has always played Oklahoma to Kenya's Texas. It

believed its bonanza had for once put it at an advantage: instead of

importing oil through the Kenyan port of Mombasa, it would build a refinery

and export petroleum products to Kenya at a premium. Uganda still has a head

start, but Kenyan officials now see their country as a regional hub that

combines geographical advantages, and its own newly discovered energy

resources, with tax breaks, skills and services.

http://media.economist.com/sites/default/files/imagecache/290-width/images/p

rint-edition/20120407_MAM939.png

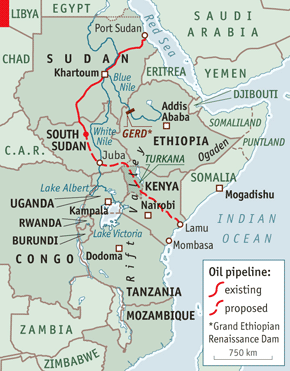

South Sudan, for years the largest oil producer in the region and locked in

an oil dispute with Sudan, now wants to send crude out through Kenya on a

pipeline to a proposed new port in Lamu (see map). Such a channel could also

serve Ethiopia, which shares Kenya's joy about their joint oil prospects.

But their winnings pale next to those farther south. Tanzania has done well

out of gold, earning record receipts of $2.1 billion last year, a 33%

increase on 2010. It will do even better from gas. The past month has seen

the discovery of enormous gasfields in Tanzanian offshore waters. That of

Britain's BG Group is big, Another, by Norway's Statoil, is bigger.

Statoil's recent gas find alone is estimated to hold almost a billion

barrels of oil equivalent (boe).

Happily, Tanzania's gasfield extends south to Mozambique, where Italy's Eni

last month unveiled a find of 1.3 billion boe, matching similar finds by an

American firm, Andarko. With plans to build a liquefied natural gas (LNG)

terminal, Mozambique could be a big exporter within a decade. At least the

vast and impoverished south of Tanzania and north of Mozambique will be

opened up to much-needed investment.

Yet the region is not just excited about fossil fuels; a parallel push

towards alternative energy is under way. Several east African countries are

keen to realise the Rift Valley's geothermal prospects. One of the world's

largest wind farms is being built in Kenya not far from the new-found oil in

Turkana. Its backers say it will produce 300MW, three times the total output

of Rwanda.

That is a drop in the bucket for Ethiopia. Its rivers, plunging from

well-watered highlands into deep canyons, have hydropower potential. Meles

Zenawi, the prime minister, has ordered the construction of a series of dams

at a total cost of over $8 billion. The jewel is the $4.7 billion Grand

Ethiopian Renaissance Dam on the Blue Nile. This should generate 5,250MW

when finished, increasing electricity production in the country fivefold,

providing a surplus for export and allowing Ethiopia to open up as a

manufacturer.

The arrival of potential energy wealth comes with risks. Instead of bringing

the region together, petro-rivalry could drive it apart. The continued

dispute between South Sudan and Sudan should serve as a warning. South Sudan

has cut off its supply of 300,000 b/d to Sudan, most of which is destined

for China, complaining that transit fees to Sudan's export terminal are too

high. The South Sudanese say Sudan has bombed its oil wells in recent weeks.

Sudan whispers that South Sudan wants to replace Chinese oil companies with

European ones. This is a sensitive point for Beijing: the Europeans have

done especially well in the new scramble for oil in Africa.

Security is another potential problem, underscored by deadly grenade attacks

in the Kenyan port of Mombasa this week by jihadists connected with

Somalia's al-Qaeda-linked Shabab militia. Heavily armed pastoralists like

Kenya's Turkana are unlikely to respect oil-company property. Ethiopia has

hit gas in the Ogaden desert, and a Chinese company, PetroTrans, wants to

invest $4 billion there. But Mr Zenawi will have to win over the region's

restive ethnic Somali population. Many oilmen suspect that Somalia itself

may contain the region's energy mother-lode; war and piracy put it beyond

reach.

Management is another test. Few of the region's governments have the

capacity to strike fair deals with big oil companies. Tanzania is not alone

in limping along with out-of-date and unsuitable laws. Nor do many have a

good record of managing public accounts for the general good. Uganda's

president, Yoweri Museveni, looks increasingly like a dynastic ruler bent on

enriching his clan. Still, the region's millions of struggling poor are

likely to be better off even if, as usual, the rich skim off the cream.

------------[ Sent via the dehai-wn mailing list by dehai.org]--------------

Received on Sat Apr 07 2012 - 18:38:51 EDT