Date: Tue, 27 Dec 2016 23:41:04 +0100

Libyan Oil: A Bittersweet Return?

After a series of skirmishes, frantic deal making now looks to have brought about the surprise return to force of Libya in the oil export market.

However Libyan oil coming back online could jeopardize a fragile production cut deal orchestrated by producers cartel OPEC to rebalance the global supply glut driving down prices and squeezing the revenues of oil-dependent economies.

A spokesman from the Libyan Government of National Accord (GNA) has confirmed that Libya will be sharply increasing its oil output in the near future, raising its total production to 900,000 barrels of oil per day (bpd).

Prior to the 2011 death of long-time dictator Colonel Muammar Gaddafi, the north African country exported some 1.6m barrels per day of sweet crude that required only slight refining. Output collapsed after Libya lapsed into revolution and then civil war.

While the new production level remains significantly lower than during Gaddafi-era heights it still represents a significant increase in Libyan output, which had already doubled to about 600,000 bpd since September.

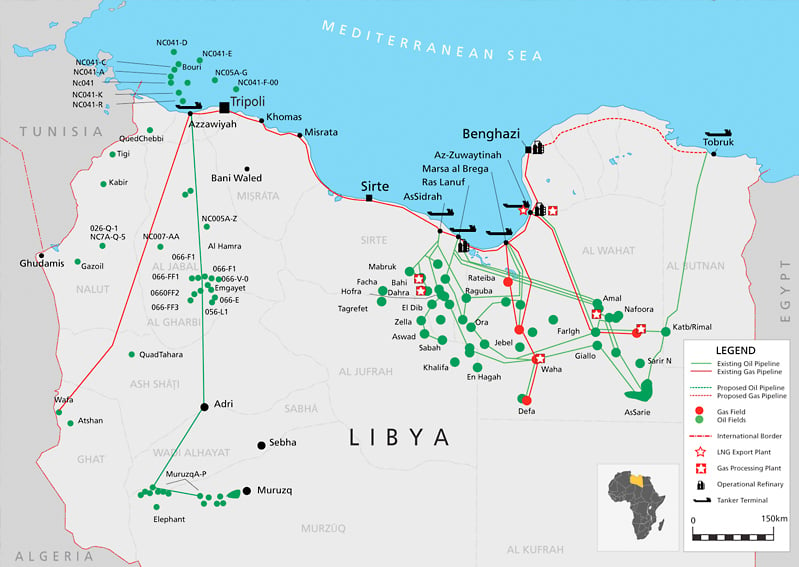

The latest rise in production comes after two of Libya’s warring factions agreed to cooperate to raise output. A group within Libya’s Petroleum Facilities Guard (PFG) agreed to lift two blockades on oil pipelines which have been in place since 2014 and 2015 respectively as they realign themselves with the Libyan National Army (LNA), one of Libya’s strongest militia groups.

The LNA had held onto two crucial oil ports during factional fighting with the PFG in September, which may have convinced breakaway PFG members to strike the new deal.

Libya’s state-run National Oil Corporation (NOC) has recently prepared to restart oil exports from these ports. With the end of the blockade on pipelines to Libya’s Sharara and El Feel oil fields, national oil officials believe they can add 365,000 bpd to Libya’s production, though they caution this is dependent on the agreement holding.

However the prospect of a Libyan production surge comes shortly after OPEC members finally managed to negotiate a reduction deal.

Despite being members of the cartel, both Libya and Nigeria have been exempted from OPEC’s recent agreements because of their ongoing security and economic problems. However a rapid increase in crude exporting from Libyan fields might change this calculus.

The reopening of the two blockaded pipelines could even bring Libya above its official 0.9m bpd target, potentially straining OPEC deals and the cartel’s willingness to allow Libya to continue producing at pace to get back on its feet.

“OPEC’s agreement granted a Libyan exemption despite this stated production target… but this exemption is not likely open-ended,” warns Jonathan Lang, an analyst for Global Risk Insights.

Production increases will likely only be gradual as Libya’s technical issues and tenuous security situation put a damper on production potential. But if production reaches or even exceeds Libya’s target they could begin to hear sharp protests from other oil producing countries, whose economies are feeling the strain of sustained low prices.

“Saudi Energy Minister Khalid al-Fali, after the conference with non-OPEC producers, gave a very strong statement to the effect that he was willing to cut the Kingdom’s production even more than agreed in order to restore market balance. If Libyan output does increase more, he may need to do that,” says Bryan Plamondon, Middle East and Africa director at IHS Market Economics.

“A return of Libyan production to world oil markets…on a sustained basis would hamper OPEC’s plan to restore oil markets to equilibrium and move prices upward. It is a serious issue for the organization.”