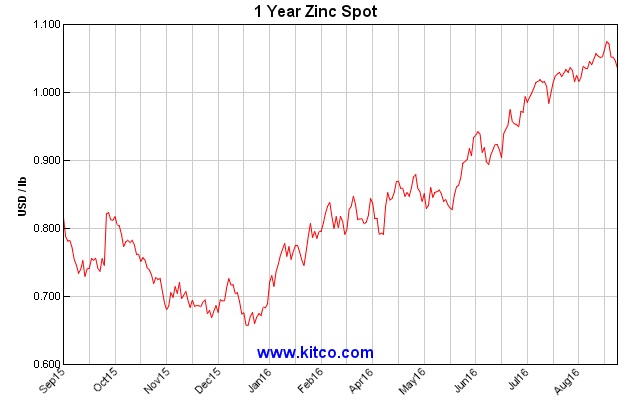

Zinc prices have soared nearly 50% since the beginning of 2016.

The rise in the zinc price is a perfect example of what happens when supply becomes constrained in a commodity market. Because of two large zinc mine closures, 60,000 tons of annual zinc supply was removed from the market earlier this year.

In addition, Glencore (OTCPK:GLCNF) took the decision in late 2015 to cutback zinc production due to low prices.

"The main reason for the reduction is to preserve the value of Glencore's reserves in the ground at a time of low zinc and lead prices, which do not correctly value the scarce nature of our resources," the Switzerland-based company explained.

Several analysts expect this supply shortage to carry on into 2017 with prices extending to $1.25/lb.

Scotiabank and CRU see the current market imbalance eroding both the known and less visible stockpiles of zinc.

Deller said, "The key question in the zinc market is no longer whether, but is now when will the market run out of metal?

Scotiabank sees this depletion of stocks happening sooner rather than later.

In its annual Global Outlook report published in early July, the bank forecast zinc prices to average US$1.25/lb. in 2017.

"Prices are expected to rise over the coming years until sufficient supply can be incentivized back onto a starved market," the bank penned in the comprehensive economic report.