Hassan bin Mujib Al-Huwaizi, Chairman of the Federation of Saudi Chambers, confirmed that the relevant Tanzanian authorities have granted the concession and acquisition rights for the Bagamoyo Port project in Tanzania to a Saudi company. This is part of a project launched by the group under the name "Eastern Gateway Project," referring to the East African region.

The Saudi Press Agency quoted Al-Huwaizi as saying that this step will strengthen the Kingdom's role as a major driver of global economic development and comes as part of its efforts to expand its foreign investments, particularly in Africa. He added that the project will enhance the Kingdom's logistics capabilities, contributing to delivering Saudi exports to global markets more effectively.

The importance of Bagamoyo Port

The Port of Bagamoyo, which began operations in 2018, represents one of the largest logistics projects in East Africa. Its strategic location on the Tanzanian coast overlooking the Indian Ocean makes it a major hub for trade between Africa and the world.

According to a report by the Observer Research Foundation (ORF), upon completion, the port is expected to become a major gateway for exporting African raw materials and natural resources to international markets, in addition to supplying essential goods to neighboring African countries.

The advantages enjoyed by the Bagamoyo Port and its industrial zone, according to the research institution’s report:

The Bagamoyo Port project is located approximately 70 kilometers north of Dar es Salaam. Work began in 2013 in a partnership between the Tanzanian government and China Merchants Holdings International, China's largest port operator, with financial support from Oman. The project aims to relieve pressure on the port of Dar es Salaam and enhance Tanzania's logistics capabilities.

Due to its strategic location, the port was once one of the largest ports in Africa, and a center of maritime trade from the 15th to the 19th centuries.

The port's construction cost is estimated at approximately US$10 billion. It was planned to build three quays capable of accommodating medium-sized container ships and handling 20 million twenty-foot equivalent units (TEUs) by 2045.

The project includes a 1,700-hectare special economic zone adjacent to the port and is connected to Tanzania's main railway networks, enhancing the potential of Bagamoyo to become a strategic investment hub in East Africa.

The project faced several challenges, most notably financing and agreements related to implementation terms. In 2019, construction was halted due to disputes over financing and ownership terms.

The port is expected to attract around 700 industries to the Bagamoyo Special Economic Zone, and upon completion, Tanzania is expected to become a regional shipping and logistics hub in East Africa.

Port of Tadjoura in Djibouti

In a new step that reinforces Saudi Arabia's strategy toward East Africa, the Red Sea Gateway International Company signed an agreement last week with the Port of Tadjoura in Djibouti to manage and operate the port for 30 years. This will contribute to enhancing the efficiency of logistics and trade operations in the region.

The agreement was signed by Kamel Mohamed, Chairman of the Board of Directors of Tajoura Port, and Gagan Seksaria, Investment Director of the Red Sea Gateway International Limited, which operates under the umbrella of the Saudi Public Investment Fund.

Under this agreement, the Red Sea Gateway International will manage the port of Tajoura, adding it to the list of ports managed by the company, which includes the ports of Jeddah, Yanbu, Neom, and Jazan. This agreement will enhance economic integration between Saudi Arabia and Djibouti and support trade between the Middle East and the Horn of Africa.

This cooperation represents a qualitative leap in the development of logistics infrastructure in Djibouti. It will contribute to enhancing the efficiency of ports and increasing their handling capacity, thus strengthening Djibouti's position as a regional trade hub and supporting the Kingdom's vision to expand its investments in the maritime transport and logistics sector internationally.

A common interest in curbing Abu Dhabi's ambitions

Regarding the expected deal with Eritrea regarding the port of Assab, the potential partnership between Riyadh and Asmara would benefit both countries economically and politically. Economically, Eritrea boasts untapped natural resources, in addition to its rich marine resources.

A report issued by the International Fund for Agricultural Development (IFAD) indicates that 26% of Eritrea's land is arable, but only 4% of it is actually cultivated. The country also possesses abundant minerals, such as copper, gold, iron ore, nickel, silica, sulfur, marble, and granite, making it a promising investment destination.

On the political front, the two countries share a common interest in limiting the influence of the UAE and its ally, Ethiopia, particularly given Addis Ababa's efforts to gain access to the Red Sea with Emirati support, a move that could pose a threat to the regional balance of power.

A report by the Italian news agency Nova suggests that the potential Saudi investment in the port of Assab is not limited to economic considerations, but rather reflects a restructuring of relations between Saudi Arabia and Eritrea to protect their interests along one of the world's busiest shipping lanes.

The report also indicates that this cooperation could provide Eritrea with the necessary support to resist Ethiopian pressure, while strengthening Saudi influence on the African continent. However, this move could provoke reactions from other regional parties, including the UAE, Turkey, and China, all of which have strategic interests in the region's maritime corridors.

Race for economic and political influence

Saudi economic expert Dr. Ali Daadoush believes that Saudi Arabia's motives for investing in East Africa are based on diversifying its sources of income and strengthening its position as a global logistics hub. He notes that this acquisition contributes to linking Asia with Europe and Africa.

Daadoush added that investing in infrastructure gives Saudi Arabia greater geopolitical influence in the region, allowing it to strengthen its relations with African countries and influence regional policies. He explained that East Africa is a developing region experiencing rapid economic growth and offers promising investment opportunities in various sectors.

In the same context, the Saudi-Emirati competition in the ports sector cannot be ignored, particularly regarding the Bagamoyo Port deal, the largest of its kind. In 2023, Abu Dhabi signed an agreement with the Tanzanian government to operate and modernize the Dar es Salaam port, located just 70 kilometers from the Bagamoyo Port project.

Under this agreement, DP World has pledged to invest more than $250 million during the first phase of the Dar es Salaam port modernization, with the potential to increase the investment to $1 billion over the concession period, in addition to logistics projects in remote areas.

Despite this investment, the Dar es Salaam port is smaller than the Bagamoyo port, which Saudi Arabia has secured a concession to operate. Saudi Arabia is expected to invest approximately $10 billion in the port. Once completed, Bagamoyo port is expected to handle approximately 20 million TEUs, 25 times the volume of cargo handled by Dar es Salaam port.

Saudi Arabia's actions in the Horn of Africa and East Africa as a whole point to a new strategy that goes beyond investment to building diplomatic and political alliances. The Kingdom enjoys a strong presence, accepted by various parties in the region, particularly after adopting a policy of appeasement since signing an agreement with Iran in March 2023. This is in addition to its political and military support for the Sudanese army in its war against the Rapid Support Forces militia, and its alignment with the new Syrian administration after the fall of Bashar al-Assad's regime.

It is also likely that Saudi Arabia will resume coordination with Qatar on foreign policy, as occurred previously during their joint support for the Syrian revolution in its early years. The Saudi-Qatari approach differs from the Emirati strategy, as Riyadh and Doha seek to achieve their interests through cooperation with legitimate governments, rather than supporting unpopular separatist entities.

This is the approach pursued by Abu Dhabi, which has faced criticism for its support for controversial parties, such as retired Libyan General Khalifa Haftar, the Rapid Support Forces militia in Sudan, and the Southern Transitional Council in Yemen, in addition to its alleged support for movements opposed to the new Syrian administration.

==

www.noonpost.com

Ethiopian Prime Minister Dr. Abiy Ahmed met with the Saudi Deputy Foreign Minister during their visit to several landmarks in Addis Ababa.

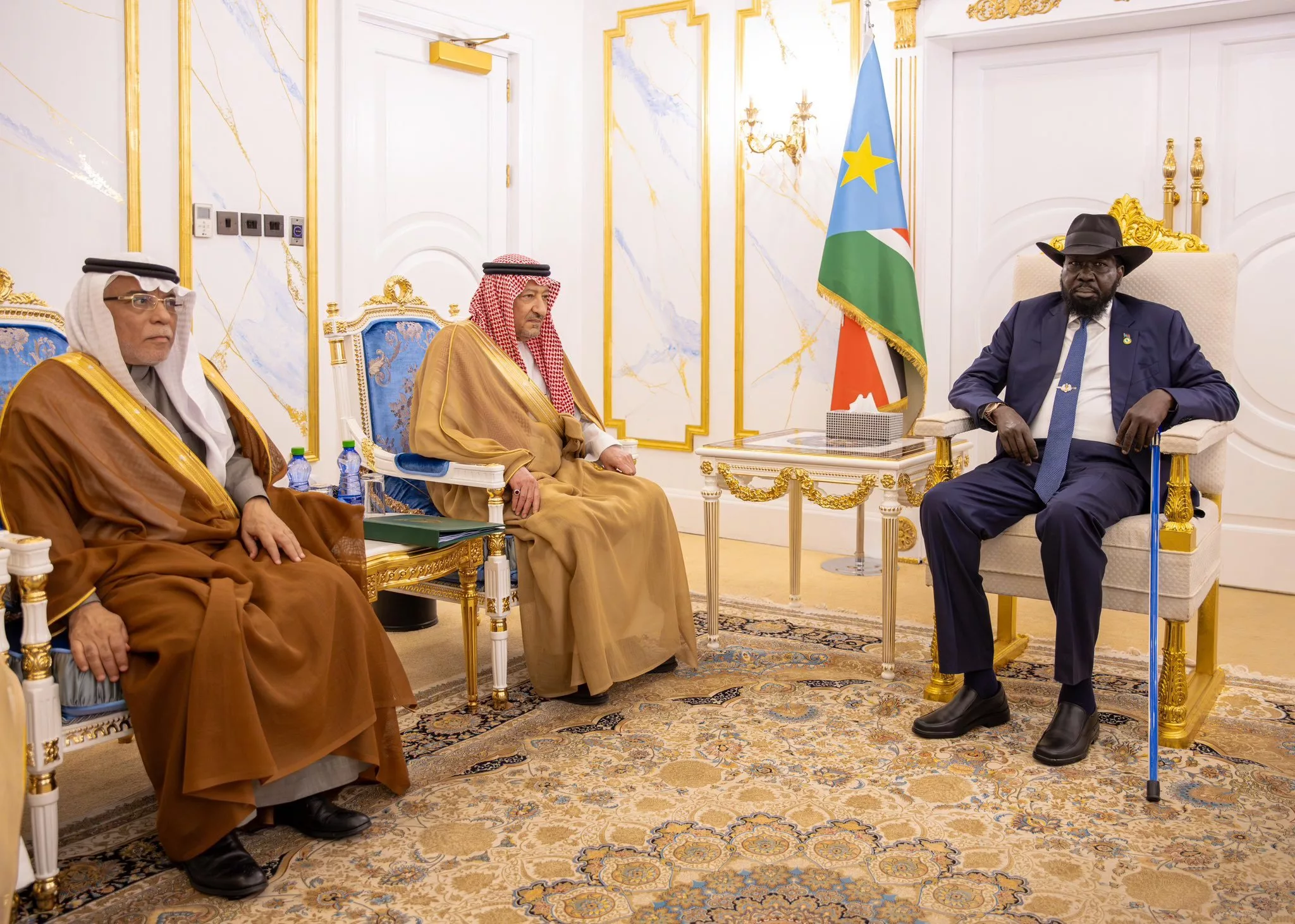

Ethiopian Prime Minister Dr. Abiy Ahmed met with the Saudi Deputy Foreign Minister during their visit to several landmarks in Addis Ababa. President of South Sudan, General Salva Kiir Mayardit, with Deputy Foreign Minister Eng. Walid bin Abdul Karim Al-Khuraiji

President of South Sudan, General Salva Kiir Mayardit, with Deputy Foreign Minister Eng. Walid bin Abdul Karim Al-Khuraiji Signing of a Memorandum of Understanding between the Port of Tadjoura in Djibouti and the Red Sea Gateway International Limited,

Signing of a Memorandum of Understanding between the Port of Tadjoura in Djibouti and the Red Sea Gateway International Limited,