Date: Monday, 20 November 2023

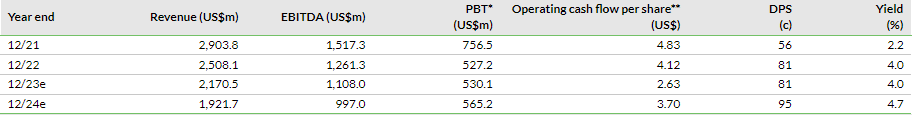

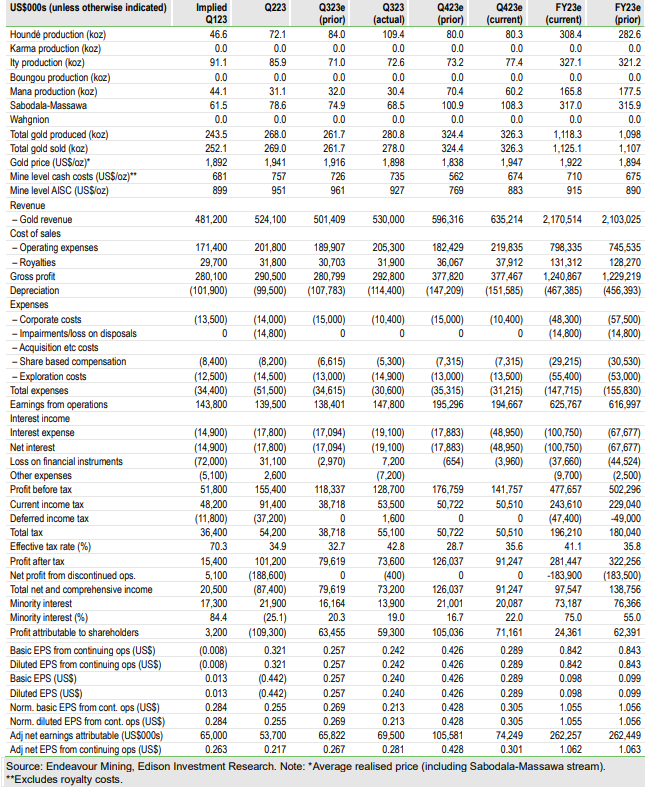

In the wake of Endeavour’s Q323 results we have updated our FY23 estimates. Endeavour remains on track to achieve its production guidance of 1,060–1,135koz at an AISC of US$895–950/oz (792koz produced year-to-date at an AISC of US$974/oz). Endeavour has reaffirmed its performance is still set to be weighted towards H223 as previously guided, with Q323 recording the strongest performance this year (production of 280.8koz) and Q423 on track to beat this (estimated at 324.4koz). Q323 results were driven by impressive production at Houndé, reporting 109koz (cf estimates of 84koz). Following the overperformance at Houndé, Q423 is set to be driven by increasing production at its other assets, namely Sabodala-Massawa and Mana.

Endeavour has continued with its shareholder returns programme, confirming the payment of a US$100m (US$0.40/share) interim dividend for H123, which on an annualised basis represents US$25m, or 14%, more than the minimum dividend commitment for the year of US$175m. This dividend payment takes total shareholder returns to US$777m since Q121, representing roughly 15% of Endeavour’s current market capitalisation and US$354m more than its minimum commitment during this period.

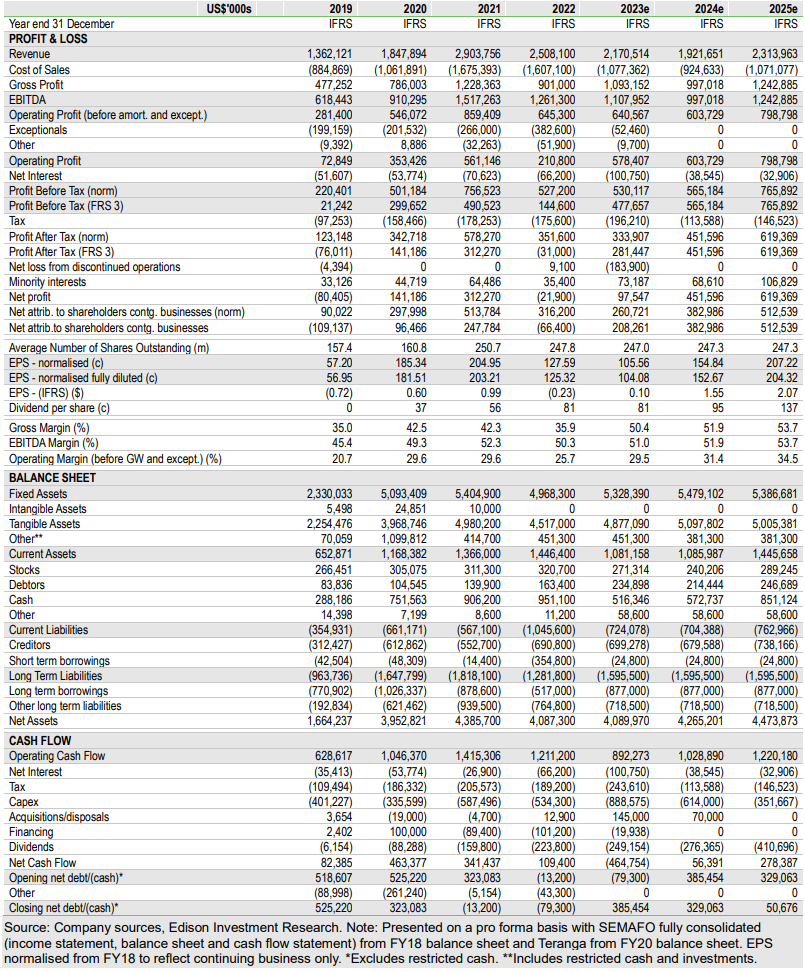

Using an absolute valuation methodology, whereby we discount back four years of cash flows and then apply a perpetual ex-growth multiple to steady-state terminal cash flows in FY26, our valuation of Endeavour is US$34.90 (C$47.97 or £28.09) per share, using a 10% discount rate. Using a capital asset pricing model (CAPM) derived using a (real) discount rate of 6.34% (based on inflation expectations of 2.4499% derived from US 30-year break-even rates) Endeavour is valued at US$59.31 (C$81.51 or £47.74) per share (cf US$55.79, previously). To these valuations a further US$4.30–7.45/share may be added to reflect the value of Endeavour’s five-year exploration programme (see The second five-year plan, published on 20 October 2021). In the meantime, we note that Endeavour is trading at a discount to its peers on at least 84% of common valuation measures when consensus forecasts are used and 77% if Edison forecasts are used. The average valuation measures of its peers imply a share price for Endeavour of US$24.50 (C$33.83 or £20.04).

As stated throughout the year, Endeavour still expects production from its remaining assets to be weighted towards H223, which has been reaffirmed by Q323 results. It expects to achieve FY23 production of 1,060–1,135koz at an all-in sustaining cost (AISC) of US$895–950/oz. The strong Q323 production figure of 280.8koz was principally the result of better-than-expected output at Houndé, which reported 109koz (cf estimates of 84koz) as stripping activity came to a close at the Kari Pump pit, providing access to higher grades. The increased production at Houndé was somewhat offset by decreases at both Ity and Sabodala-Massawa (owing to lower throughputs and lower average grades). However, our forecasts for Q423 expect production to increase at both these assets, including Mana, which will ultimately drive production in Q423.

Following the divestment of Boungou and Wahgnion, discussed in our last note, Endeavour continues to support the growth of larger, low AISC and longer-life assets such as the Lafigué greenfield project and the Sabodala-Massawa BIOX expansion, which remain on budget and on schedule for start-up in Q224 and Q324 respectively. At the same time Endeavour continues with its exploration efforts, with US$78m of its intended US$80m FY23 budget now spent and it expects to come in slightly over its estimates for FY23.

As a result, we estimate Endeavour’s earnings from mining operations should continue to improve into Q423:

Note that Endeavour changed its definition of cash costs in Q420 to include royalties. The decision was made so that Endeavour could be more consistent in reporting in the context of its peer group. For reasons of comparability with past results, however, as well as ease of forecasting (given royalties are reported as a standalone item distinct from operating expenses), we are continuing to present total cash costs excluding royalties.

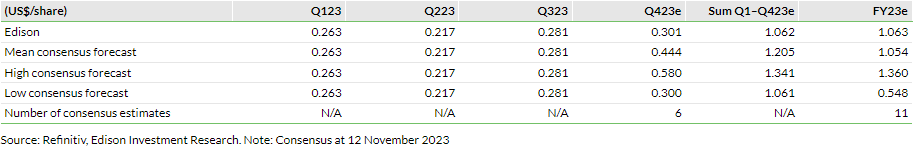

In the wake of the changes made to our forecasts, a comparison between our quarterly and full-year forecast and consensus forecasts for FY23 adjusted net EPS is as follows:

Readers should note the discrepancy between the ‘FY23e’ column and the ‘Sum Q1-Q423e’ column in the exhibit above, which strongly suggests that the analysts who are publishing quarterly forecasts are not the same as the ones who are publishing annual forecasts.

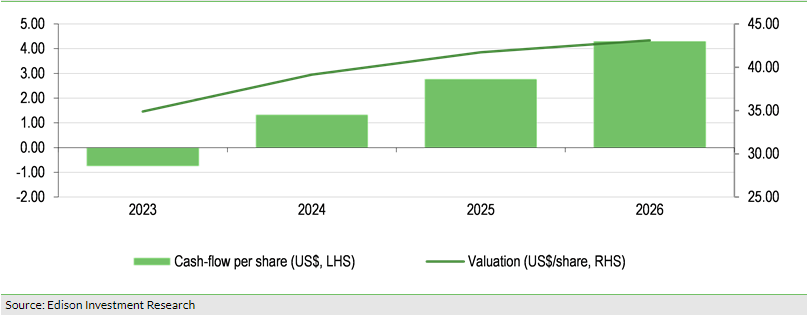

Endeavour is a multi-asset company that has shown a willingness and desire to trade assets to maintain production, reduce costs and maximise returns to shareholders (eg the sale of Youga in FY16, Nzema in FY17, Tabakoto in FY18, Agbaou in FY20, Karma in FY22 and Boungou and Wahgnion in FY23, and the acquisition of SEMAFO in FY20 and Teranga in FY21). Historically, rather than our customary method of discounting maximum potential dividends over the life of operations back to FY23, for Endeavour we have opted to discount four years of forecast cash flows in FY23–26 back to FY23, then apply an ex-growth terminal multiple of 10x (consistent with using a standardised discount rate of 10%) to forecast cash flows in that year (ie FY26). We would normally exclude exploration expenditure from such a calculation on the basis that it is an investment. In the case of Endeavour, however, we include it because it is a critical component of the company’s ability to continually expand and extend the lives of its mines.

We have updated our FY26 cash flow estimate to US$4.31/share (cf US$4.08/share previously), which implies a terminal valuation of Endeavour at end-FY26 of US$43.0/share, calculated using a discount rate of 10%. With forecast intervening cash flows, this terminal valuation then discounts back to a present valuation of US$34.90/share (cf US$33.52/share, previously) at the start of FY23, as shown in Exhibit 3.

Now that Endeavour is one of the world’s most important producers of gold, we believe it can increasingly attract lower-cost finance, which leads us to also consider a CAPM-derived valuation. Long-term nominal equity returns have been 9% and 30-year break-evens indicate an inflation rate of 2.4499% (source Bloomberg, 13 November 2023) versus 2.4197% previously. These two measures imply an expected real equity return of 6.34% (1.09/1.024499) and applying this to our forecast cash flows would imply a terminal valuation for Endeavour of US$67.97/share (US$63.46/share previously) and a current valuation of US$59.31/share (US$55.79/share previously).

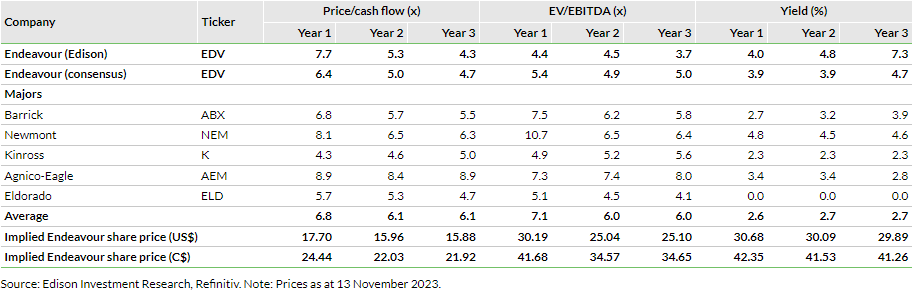

Endeavour’s valuation on a series of commonly used measures relative to a selection of gold mining majors (the ranks of which it has joined since its takeover of SEMAFO and Teranga) is as follows:

Of note is that, without exception, Endeavour’s valuation is lower than the averages of all nine of the measures shown in Exhibit 4 when consensus forecasts are used and eight of the same nine measures when Edison’s forecasts are used. On an individual basis, it is lower than its senior gold mining peers on at least 38 out of 45 (84%) valuation measures if Edison forecasts are used and 35 out of 45 (77%) valuation measures if consensus forecasts are used. Reverse engineered, the average valuation measures of its peers suggest a share price for Endeavour of US$24.50 (C$33.83 or £20.04), implying the share price is at a 17.8% discount. The current London Stock Exchange share price is £16.48, equivalent to US$20.16 at an exchange rate of US$1.2230/£.

General disclaimer and copyright

This report has been commissioned by Endeavour Mining and prepared and issued by Edison, in consideration of a fee payable by Endeavour Mining. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom